2024 Form 1040 Schedule Calculator – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . In other words, taxpayers with uncomplicated tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are .

2024 Form 1040 Schedule Calculator

Source : thecollegeinvestor.comUS IRS 1040 form or US Individual income tax Concept, accountant

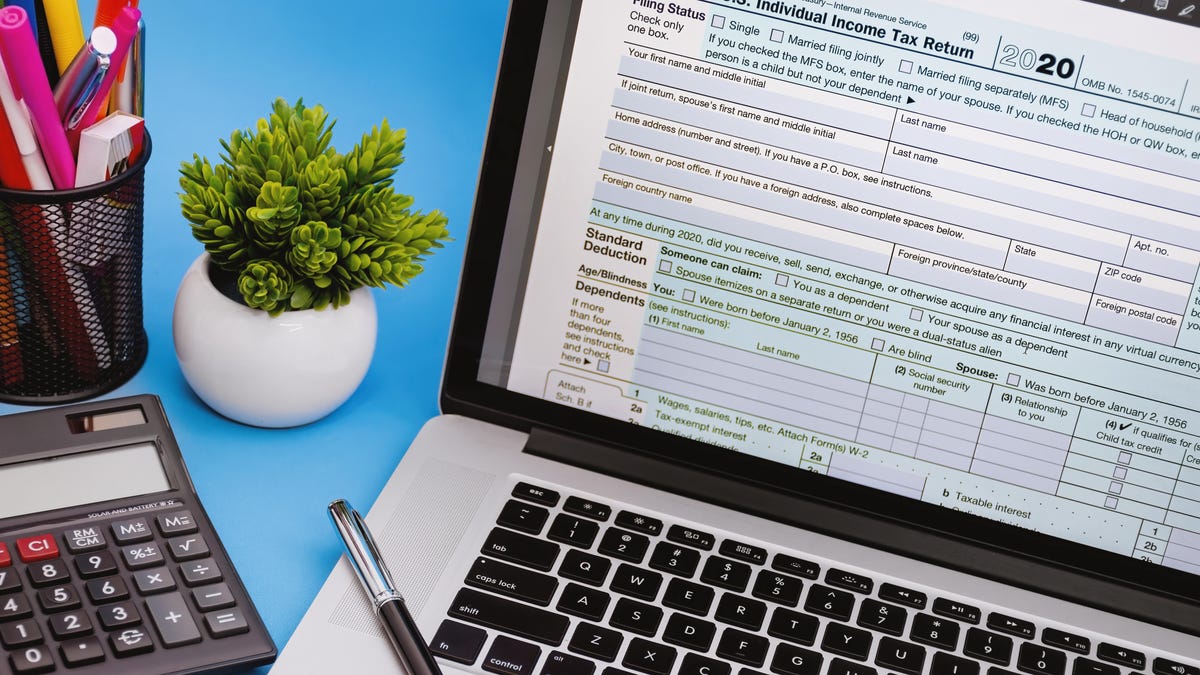

Source : www.vecteezy.comTax Season 2024: How to Create an Online IRS Account CNET

Source : www.cnet.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgUS IRS 1040 form or US Individual income tax Concept, accountant

Source : www.vecteezy.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comUs Budget: Over 30,783 Royalty Free Licensable Stock Photos

Source : www.shutterstock.comIRS announces new income tax brackets, higher standard deduction

Source : centraloregondaily.comUS IRS 1040 form or US Individual income tax Concept, accountant

Source : www.vecteezy.comFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.com2024 Form 1040 Schedule Calculator When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . W2 Form: A W2 form is the wage and tax statement provided by your employer. W2’s are issued to everyone who worked and was paid by an employer during the previous year unless all wages were exempt .

]]>